The Free Market: An Argument Against Minimum Wage

Former Speaker of the House Nancy Pelosi campaigning for a minimum wage increase

For the last century, the minimum wage has been a centerpiece of conversation—whether it be over the dinner table or in congress our lives and political conversation. Challenges have occurred in the search for a balance between a living wage, and the unemployment and inflation risks of minimum wage. These challenges can be solved by removing the minimum wage entirely.

The debate over what the minimum wage should be can be traced to the start of the program, in 1938. In recent years, Democrats have pushed for a $15 per hour minimum wage while Republicans have been reluctant to do so. Democrats believe $15/hour balances providing a living wage for workers with a minimal rise in unemployment and inflation. Republicans, on the other hand, generally believe it should be increased, just not by so much. Recently, a Forbes article noted that most Republicans support an $11/hour minimum wage.

A perfect balance cannot be found by politicians or bureaucrats, but instead must be found in the natural movements of the market. Our country and the world go through various phases of financial prosperity. As such, wages must be adjusted. In the current system, these policies can be enacted either too slowly or rashly. However, in a system in which wages are completely determined by the free market, the economy would intrinsically adjust wages based on the situation.

One recent example illustrating the failure of our current wage system is the COVID-19 pandemic, which caused a rapid global shutdown of businesses and slowed economic activity, leaving many without financial support and stability. With increasing unemployment at hand, the U.S. government pushed out stimulus bills which provided a steady stream of cash for essentially doing nothing. Although these stimulus bills provided Americans with relief, the hefty cost that came with printing out so much money in such a short period of time quickly caught up with the economy. Now, there is record inflation which indirectly reduces wages.

The minimum wage is nearing a low. But, when inflation is taken into account, overall wages in the US are actually increasing. This is because as the economy has reopened, businesses have needed to hire workers to work in their previously closed stores. This leads to natural competition between companies to snatch the available workers, and one of the best ways to attract workers is to increase salaries.

This phenomenon has shown the market is able to naturally adjust to economic conditions, reaching an equilibrium on wages and inflation our legislators have struggled to find. Some companies have been offering wages above even the Democrat recommendation of $15/hour, with Amazon offering a base salary of $18 an hour and Costco offering $17/hour.

Following this logic, in which the market naturally adjusts to the conditions, it would make sense that when there is a market downturn and businesses cannot afford to pay wages, they must reduce salaries, to mitigate the threat of bankruptcy. Deflation, which is when overall prices drop, would logically occur because as the economy shrinks and people cannot spend as much, purchasing power would increase.

However, deflation is not automatic during recessions. Mike Moffatt, an economist who teaches at the Ivey School of Business at the University of Western Ontario, describes that, “while the inflation rate rises during a boom and falls during a recession, it generally does not go below zero due to a consistently increasing money supply.”

The rate at which the money supply increases is typically exacerbated during times of distress because of stimulus bills such as the ones recently sent during the pandemic. This same behavior also happened during the 2008 financial crisis, in which the U.S. government pushed out stimulus bills and large bailouts.

There may be consumer psychology-related factors that prevent prices from decreasing during a recession- more specifically, firms may be reluctant to decrease prices if they feel like customers will get upset when they increase prices back to their original levels at a later point in time,” said Moffatt.

These psychological factors are all on the consumer side, but the employee is the other half of the story. Businesses may need to cut the salaries of their employees, but that may not be possible because of the minimum wage. The minimum wage is artificially stopping the natural flow of the market. This may lead to the use of other cost-cutting methods such as reducing the size of their workforce or using questionable strategies against the consumers, such as making the product smaller and keeping the same price or marginally higher—which is known as shrinkflation.

If minimum wage no longer existed, we would remove the dam holding up the natural flow of the economy. Though employees wouldn’t initially be happy with a pay cut, such a measure would allow them to keep their jobs and force the price of goods to drop. This is because most consumers are workers themselves. After a pay cut, they wouldn’t be able to afford the previous prices of goods. This would force the market to naturally drop prices, so the consumers can afford the goods. Once the downturn has passed, people will be spending more and the economy will return to growth, naturally increasing the prices of goods and, by extension, wages.

Moreover, because every city or region has a different cost of living, large economic disparities begin to occur under a fixed, one-size-fits-all minimum wage system. Although in the US some states and cities have their own minimum wage laws, they’re often unbalanced. One example is New York City. According to Payscale, the cost of living in NYC is 155% higher than the national average. Yet their minimum wage is $15, which is only around 105% more than the national minimum wage ($7.25). This means that by working and living in NYC, workers are making less than most other places in the US. Sacramento represents the same issue but in a different direction. Payscale notes that the cost of living in Sacramento is only 20% higher than the national average, but the minimum wage is $15.50. When compared to the national average, the minimum salary is approximately 115% more than the national average. This means that in NYC the minimum people make is less than most areas in the US, relative to cost of living, but in Sacramento the minimum salary is more than most areas in the US relative to cost of living. This illustrates that even when states and cities are given the ability to change their wage policies, oftentimes they aren’t able to balance them and make them fit the market conditions equitably.

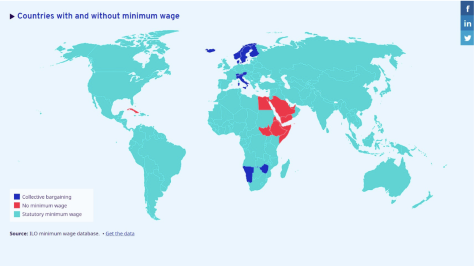

As of now, over 90% of all countries have a minimum wage policy—albeit with significant differences. Most developed countries without a minimum wage have a collective bargaining policy of some sort. This collective bargaining system is often called the Nordic model, as it was pioneered in the Nordic region.

The Nordic model is a type of social democracy, a democratic welfare state with a large emphasis on unionization and state-owned companies. This means the economies of these countries are controlled by unions and the government. These institutions are expected to provide all the necessities for the people, and they are able to substantially influence the price of goods. The problem with this system is the lack of adaptability to market conditions and the inability to find a balance between wages being too high or too low. This is especially true in an economy much larger than these Nordic countries—trying to determine a perfect balance in an economy as large and complex as the US is a near-impossible task. Furthermore, these Nordic countries have some of the highest taxes in the world to pay for all these social benefits. According to the Organization for Economic Co-operation and Development, tax revenue as a percentage of GDP for Norway was 39.9%, 42.9% in Sweden, and 46.3% in Denmark. When juxtaposed with 24.5% in the US, you can see the large disparity in tax rates. This means the government takes the role of administering healthcare, education, and other services that are “essential.”

However, the Nordic model leaves little room for personalization, which many people need. For example, according to the Swedish government, “patients should wait no more than 90 days to undergo surgery or see a specialist, yet every third patient waits longer.” This includes critical surgeries such as heart surgery, prostate cancer surgery, and childbirth (among others). Such long wait times often come at the cost of human well-being and can be dangerous for more severe health problems. However, a freer market system allows consumers to choose better options that fit them better on an individual level. Moreover, higher taxes hurt businesses which could push them to move out of the US and seek lower tax rates and more friendly economic environments overseas.

Many critics of the “free market” ideology go back to the early 1900’s, when the US economy was monopolized by a few extremely powerful people. They paid workers next to nothing, and people were forced to work for them and accept meager wages because there was no alternative. Monopolization is a major drawback of having a completely free market, as it takes away the employee’s options, and without any other choices the employee has no leverage and freedom to find the best possible salary and job. This also makes it so that the monopoly no longer needs to continue innovating because the fear of falling behind competitors is no longer there. This is why if a more free market system were to be adopted, it is extremely important to also have a transparent and strict antitrust committee. The committee should not be scared to block mergers and acquisitions and should remain unbiased politically and economically.

The solution to our inequities and struggles with wages lies not in having politicians manually adjust an artificially determined minimum wage, but instead in letting the natural ebbs and flows of the market dictate wages. By utilizing this approach, we can remove the limits holding back wage growth while giving the market the ability to reduce wages when needed to preserve jobs— leading to a brighter financial future.